Divestitures

- Home

- Our Services

- Divestitures

We Manage Divestitures

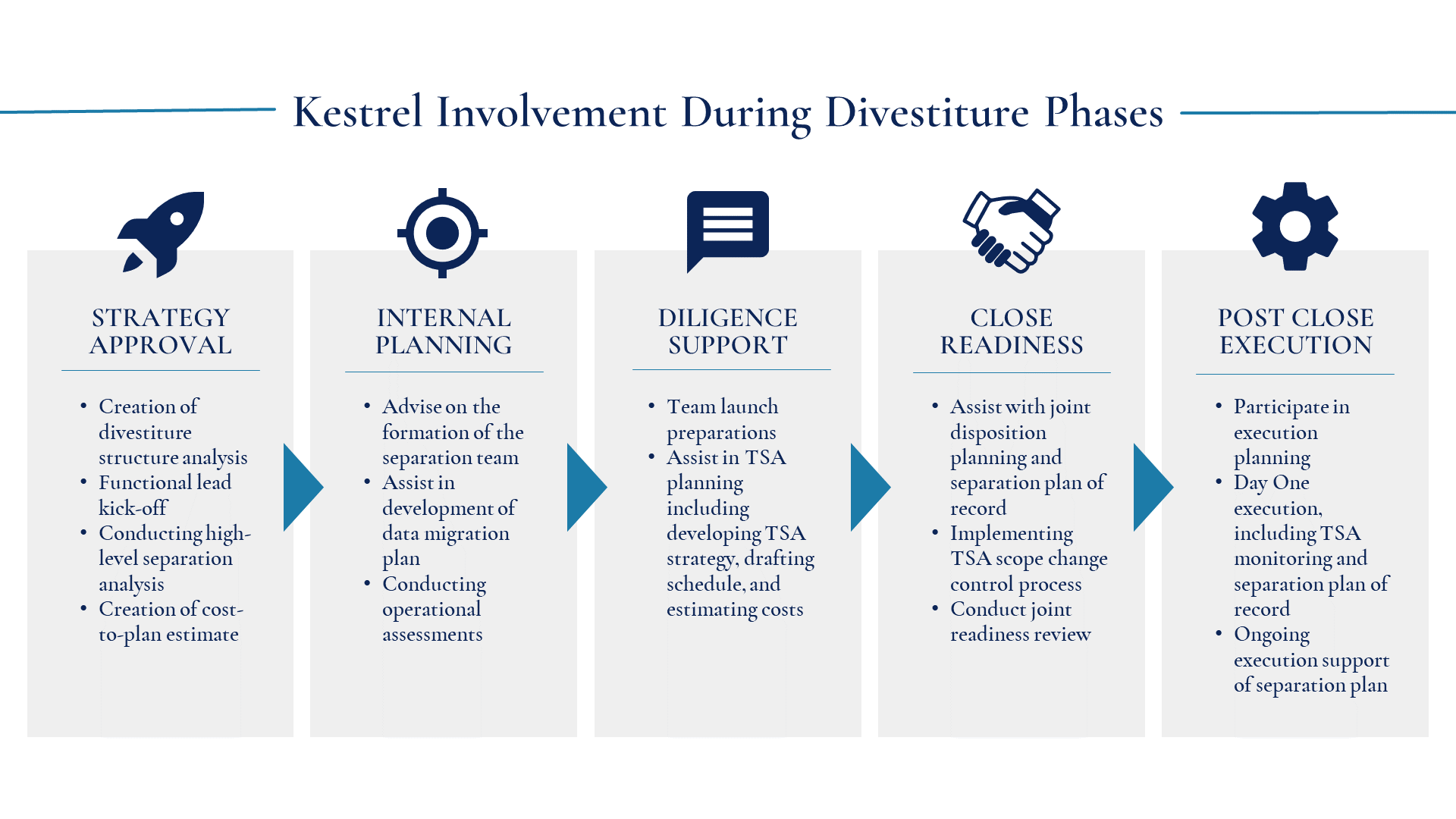

Divestitures, also known as spin-offs, spin-outs, or carve-outs, present unique challenges because they typically involve the operational separation of an entity from the parent company. The Kestrel team has experience in managing the spin-out process from the evaluation of companies that are interested in acquiring the divestiture candidate to developing transition services agreements (‘TSAs’) and managing the divestiture throughout the period covered by the TSAs and any contingencies agreed upon by the parties.

How It Works & How We Do It

Our specialist consultants are focused on making you and your organization successful. We

- organize the Divestiture Management Office (‘DMO’) and divestiture governance structure

- provide and customize tools and processes tailored to the Client’s circumstances and needs

- provide direction and advice to the Client’s DMO lead

- lead daily DMO meetings to organize all work required for successful separation

- run critical workshops like ‘walk-the-wall’ planning sessions

- assemble a playbook for future divestitures and a DMO cheat sheet, if desired

Sample Data:

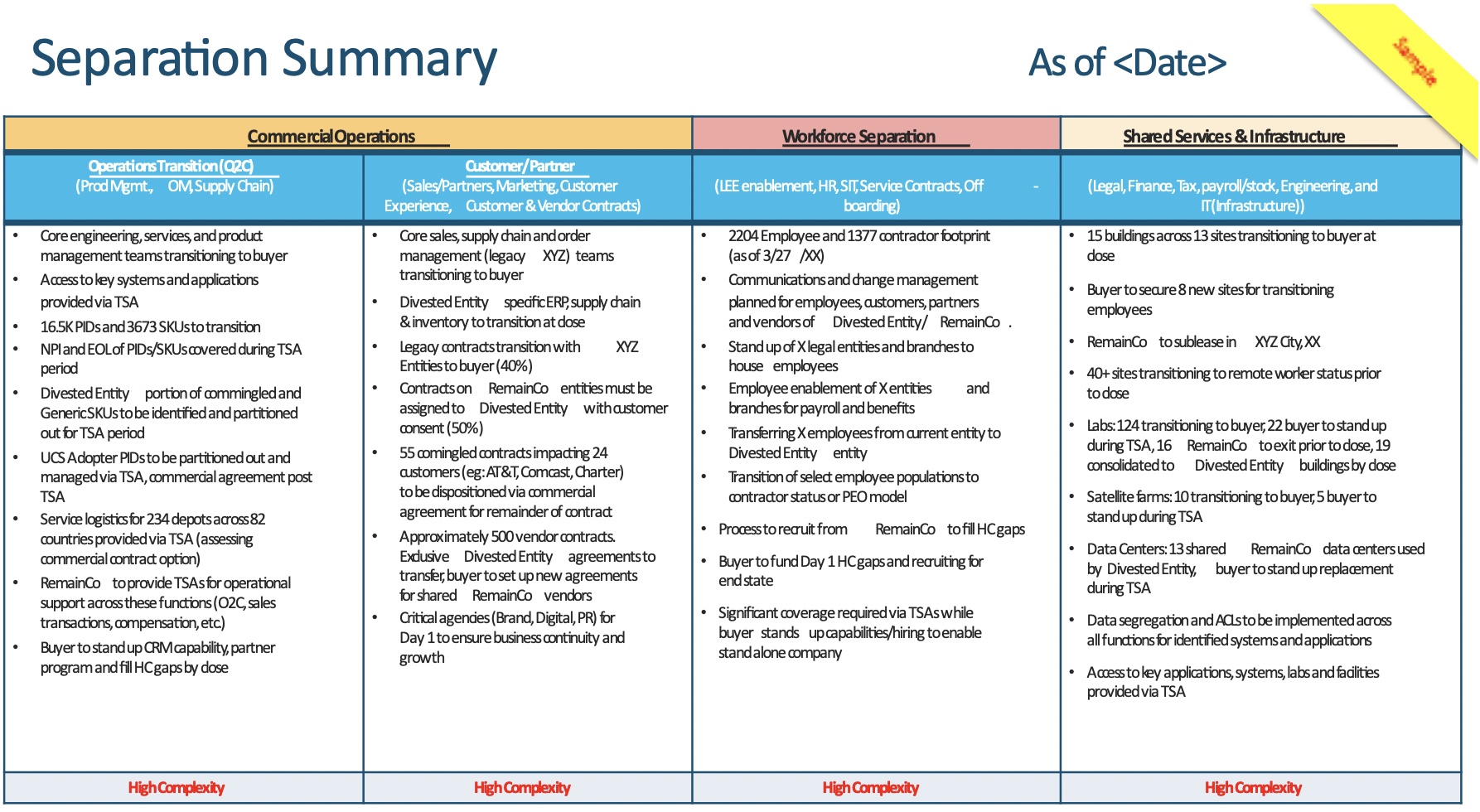

The carve-out of a major divested entity with thousands of employees requires careful orchestration of activities that fall in three major categories:

Commercial Operations

- Operations transition (Q2C)

- Customer and partner separation

Workforce Separation

- Stand up of legal entities to house employees

- Transition of employees including benefits of payroll

Shared Services and Infrastructure

- Building transition

- Labs, data centers, and data segregation