Spirent Communications: Acquisition Integration of octoScope

- Home

- portfolio

- M&A Integration

- Spirent Communications: Acquisition Integration of octoScope

Situation:

Spirent Communications PLC, a UK-based test and measurement company with major operations in the U.S. decided to acquire octoScope to increase its wireless testing capabilities. octoScope was headquartered on the east coast of the U.S. with a branch office in Silicon Valley. octoScope’s business was growing rapidly with the build out of 5G, and it sold a few product lines in the U.S. and various countries globally. In the U.S., sales were primarily through its own salesforce, while distributors were used in other geographies.

Spirent’s last acquisition was about seven years ago, and therefore the organization’s ‘muscle’ to manage an acquisition integration had largely atrophied. Spirent’s management team was looking for assistance to plan and execute this integration while capturing best practices in a playbook for future acquisition integrations.

Kestrel Partners Engagement:

Kestrel provided the integration management office (‘IMO’) lead consultant as part of a small team of consultants from Pritchett, LLC. The lead consultant was responsible for collaborating with the Spirent Integration Manager to set up the infrastructure for a successful integration and to lead the teams through planning and execution of the integration. The engagement scope included determining the integration governance structure, kicking off, mobilizing, and on-boarding the teams, setting meeting cadence, coordinating the work, and managing the interdependencies between teams. It also included identifying or creating the appropriate project management tools, training team members in their use, and solving problems as they arose during the planning and execution phase of this project. Of particular importance was the definition of value driver metrics, identification of owners, and the creation of a synergy capture plan.

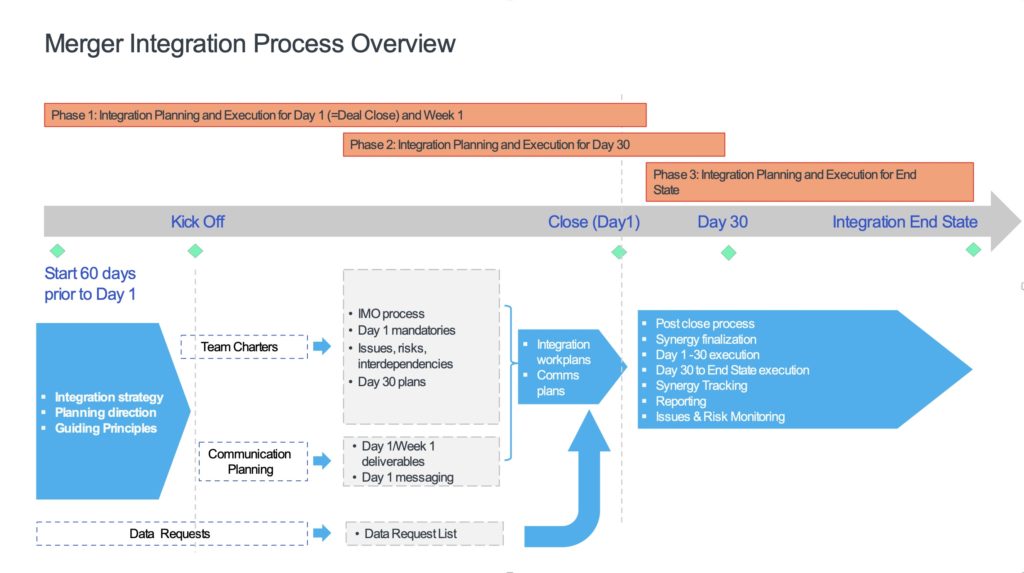

The integration methodology was adjusted to meet Spirent’s needs, and team members were trained as the project progressed. Considering that for many team members this was their first M&A integration project, a 3-phase approach to planning and execution was adopted. These 3 phases overlapped which allowed the integration team to develop a certain routine working as team on planning and execution activities. The first phase covered everything through the deal close. This phase was dominated by communications-related activities and mandatory activities driven by the change of control. The next phase covered all activities leading up to Day 30, while the 3rd phase covered the time period to the integration end state. For phases 2 and 3, an integration plan validation workshop was held to review the plan and validate timing and dependencies. In addition, key communications deliverables were identified.

The graphic below shows the high-level approach taken for this integration project.