Large Acquisition by Major Tech Company

- Home

- portfolio

- Carve-Outs

- Operational Transformation

- Large Acquisition by Major Tech Company

Situation:

Major Tech player had small security product offering, but felt it needed to grow to be the number 1 or number 2 player in its market. This company was primarily a hardware vendor, but it wanted to substantially increase its software and services offerings. The acquisition target was a 700 employee company with about $700m in annual revenue, comprised of hardware, software, and services offerings. The software elements of the target complemented the offering of the acquiror, and a small skunkworks team of engineers from both companies worked ahead of the deal closing on critical path items to accelerate the rollout of a new product incorporating these software elements from the acquisition target.

Kestrel Partners Engagement:

Kestrel covered two roles in this consulting project: The integration management office (‘IMO’) lead project management role, and the workstream lead for the product management and technology introduction workstream. These resources worked seamlessly with acquiror’s staff and other consultants. The scope of the engagement was both advisory and staff augmentation. The IMO project management leader worked closely with the client’s integration lead and had dotted line reporting relationships to sixteen project managers in the various workstreams. Their engagement ended when the vast majority of the workstreams had completed the integration.

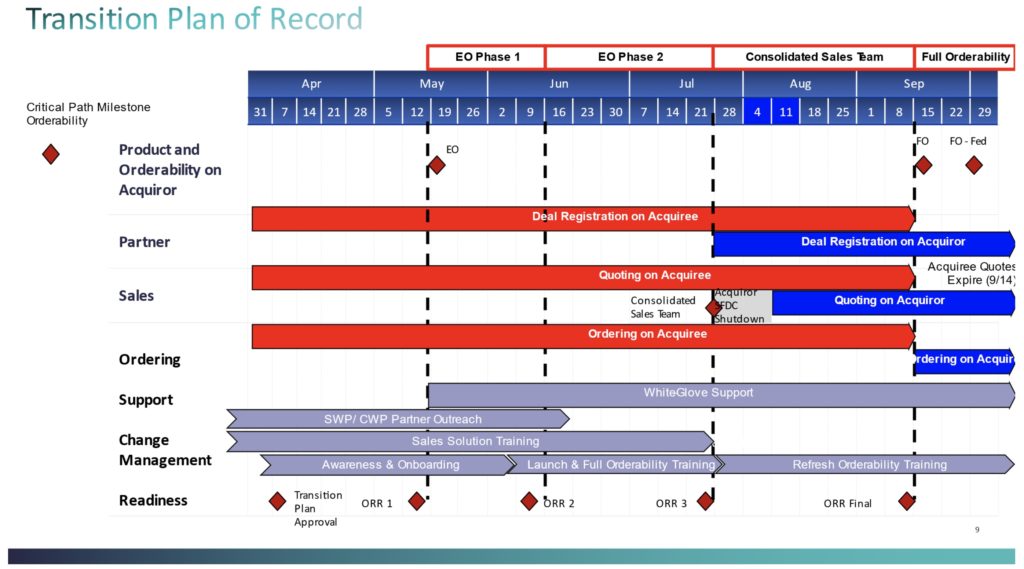

Due to complexities in the product and technology integration as well as differences in commercial operations models between acquiror and acquiree, leadership decided to have a staged orderability of acquired products on the acquiror’s tools, systems, and processes. This enabled the major tech player to capture a market window for a first new product with the acquiree’s technology by making it available in the first orderability event. It also minimized sales risks and disruptions of the acquiree’s other product lines which were scheduled for orderability on the acquiror’s systems and processes in later orderability events. The graphic below shows the plan of record of transitioning key commercial processes from the acquiree to the acquiror.