M&A Integration

- Home

- Our Services

- M&A Integration

We Manage M&A Integration Projects

The Kestrel team is experienced in the integration of large and small acquisitions from the initial planning stage to the complete integration, including the wind down of redundant legal entities. Our experience ranges from small deals in the single millions of dollars to deals larger than one billion dollars. We routinely coordinate across all parts of an organization and between internal business units and functions as well as with external advisors. In larger transactions, we have often worked seamlessly with consultants of other firms, including members from Big 4 or strategy consulting firms.

How It Works & How We Do It

Our specialist consultants are focused on making you and your organization successful. We

- organize the Integration Management Office (‘IMO’) and integration governance structure

- provide and customize tools and processes tailored to the Client’s circumstances and needs

- provide direction and advice to the Client’s IMO lead

- lead daily IMO meetings to organize all work required for successful integration

- run critical workshops like ‘walk-the-wall’ planning sessions

- assemble a playbook for future M&A Integrations and an IMO cheat sheet, if desired

Sample Data:

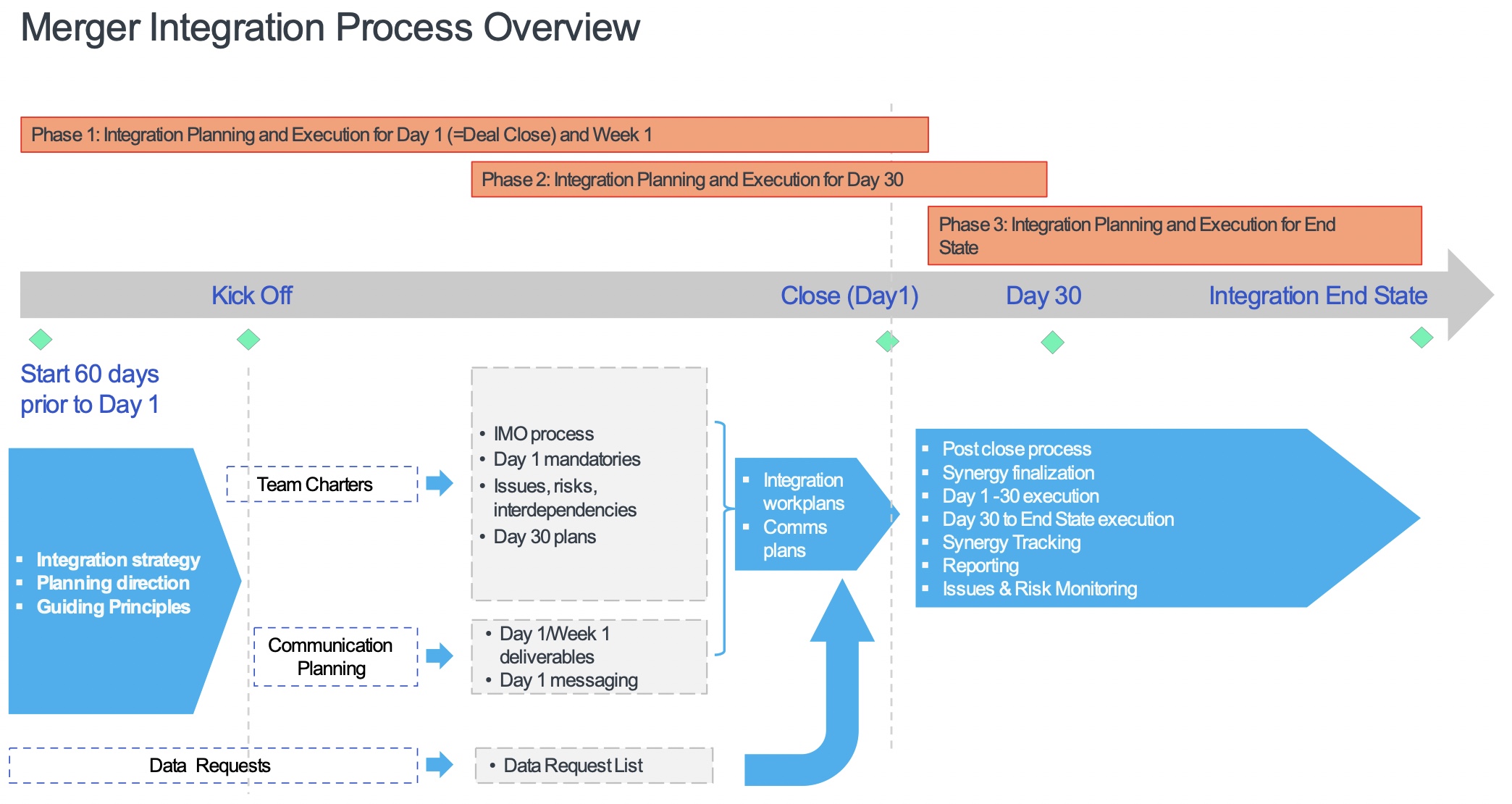

For a client with relatively little M&A integration experience, a 3-phase integration approach has been proven successful.

Phase 1: Integration Planning and Execution for Week 1

- Covers the time period to the transaction close plus one week.

- Dominated by communications-related activities and tasks that need to be completed within the first week under new ownership.

Phase 2: Integration Planning and Execution for Day 30

- Covers the time period to 30 days after transaction close.

- Dominated by tasks that need to be completed within the 30 days under new ownership.

Phase 3: Integration Planning and Execution for End State

- Covers the time period to the integration end state. This end state may be different for the various workstreams.